- Category: Banking

- Written by Paul William

- Hits: 10376

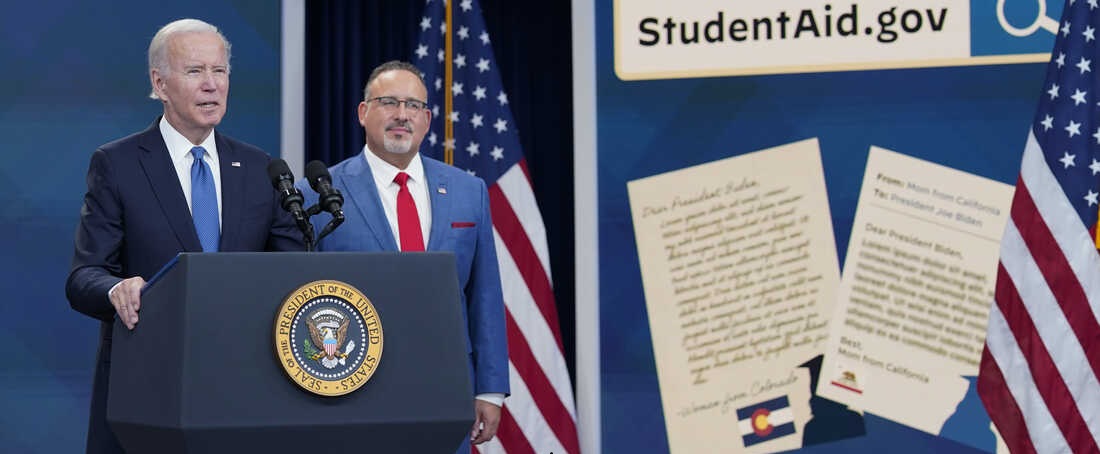

Biden Student Loans

Biden Student Loan forgiveness are schemes that allow a borrower to defer, delay or cancellation of student loans. Not everyone is eligible for student loan cancellation. Our team of 10 have researched thoroughly and we will give you all the details in regards to Biden student loans. We have spent more than 200 hours to collect all the information, re-verify those information and then created this article for you.

We have divided the topic into 4 parts so that it will be easier for you to understand, Here are the points

- Biden Student Loan Forgiveness

- Biden Student Loans Qualification

- Student Debt Relief Application

- Important dates for Biden Student Loans

Biden Student Loan Forgiveness

Biden government has compiled a three part plan - relief, extension and system updation. Everyone is eying on debt relief, however, to be eligible for it one needs to meet certain eligibility criteria, we will discuss those points in the next paragraphs. Student loan forgiveness is the master plan of the present government, the beneficiary numbers would be around two millions. The total cost will be approximately $400 billion dollars, it is huge sum of money.

Biden Student Loans will take 30 years for the plan and would be added to the country's deficit. They have started accepting applications. The last date is 31st December 2023. One can apply online here else can apply offline.

Biden Student Loan Video

DT Simple Youtube Embed

Biden Student Loan Qualification

To be eligible for Biden student loans, you need to meet certain eligibility criteria as drafted by the U.S. department of Education. Please read it carefully, it will help your application to get through.

Debt relief eligibility criteria :

- You have not filed for income taxes as your income is low

- If you are single your annual income should be less than $125,000

- If you are married and filed jointly, it should be under $250,000

- For widow it is under $250,000

- Eligible Biden student loans - (a) William D. Ford Federal Direct Loan (b) Federal Family Education Loan (c) Federal Perkins Loan Program (d) Defaulted loans (includes ED-held or commercially serviced Subsidized Stafford, Unsubsidized Stafford, parent PLUS, graduate PLUS; and Perkins loans held by ED)

- Defaulted loans are eligible

- The maximum eligible amount $20,000 if you received a Federal Pell Grant

- The maximum eligible amount $10,000 if you did not received a Federal Pell Grant in college

- Loan balances after 1st July 2022 are not eligible for Biden student loans debt relief

- You will be considered dependent if your date of birth is on or after 1st Jan 1998, You are an undergraduate student enrolled in between 1st July, 2021, and 30th June, 2022.

Biden Student Debt Relief Application

Follow the steps below to fill the online application form for debt relief

- Got to https://studentaid.gov/fsa-id/sign-in/landing

- Click on create an account

- Go to Get Started tab

- Provide all the details name, DoB and SSN, click continue

- Create your username and password click continue

- Provide your address and contact details

- Create FSA ID

- Answer all the challenge questions

- Confirm all the details

- Verify your secure code sent to your email and you are done

Important dates for Biden Student Loans

- Online application for debt relief starts from October 2022

- Last date of submission is 31st December 2023

- Loans taken on or before 30th June 2022 are eligible for debt forgiveness

- You will be classified as dependent if enrolled as an undergraduate student between July 1, 2021, and June 30, 2022, born after Jan. 1, 1998 and you are single

Do's and Don'ts

- Do not provide wrong information as this will lead to application rejection

- Apply only after reading the the eligibility criteria carefully

- Biden student loan relief is created for financially weak Americans, do not trick the system

- All borrowers should try to submit the form before mid November 2022, so that it can be processed before payments resume in January 2023

There is mixed perception, some says student loan relief is going to help in mid term election to attract young voters. Some says relief amount should be at least $40,000.

Taxes on Biden student debt relief

There is no tax at the federal level for one time but states may be taxing as per the law of the land, you need to check how it works in your state.

Biden Student Loan Q&A

Question : I am not from United States but I study in America, I have taken student loan from bank in my home country. Am I eligible for debt relief?

Answer : No, you should be a citizen of U.S. foreigners are not eligible.

Question : I am American citizen, I have taken loan from private lender. Am I eligible for student loan forgiveness?

Answer : You are not eligible because private student loans are not controlled by U.S. government.

Question : I am still a college student, am I eligible for Biden student loan forgiveness?

Answer : All college going students are eligible if you fall under "dependent" category.

Question : I am an American working in a different country, can I apply?

Answer : Yes, you can but make sure you check the other eligibility criteria.

Question : We are divorced couple and we have a joint student loan, how should we proceed?

Answer : You can separate the loan and then apply for debt relief individually.

Biden Student Loan Conclusion

Student loan forgiveness was there earlier as well, however, Biden changed many aspects of it, now millions can get the benefit. Earlier very few were eligible, students are the assets of a country they should get all the benefits, as this will uplift their moral and self confidence. Whatever be the reason students should get benefits from left right and center. This will lead to better future and a better nation.

The process is fast and simple, you can do everything online. The system is created in such a way that it can withstand heavy traffic, thousands of Americans will be submitting forms simultaneously, they made it sure that the system doesn't crush. We will keep updating you if something new comes up.